Indian brands face considerable trust gap in western markets: Edelman Trust Barometer Special India report

PR News

Paarul Chand

India’s position and proposition as a global investment destination are well known. Brand India as a whole is ascendant, bolstered by the nation’s soft power, as well as conditions that have made doing business in the country significantly better.

This study looks at the other side of the coin. As India Inc. increases its engagement with the world, whether entering markets abroad or acquiring assets, public perceptions and trust in Indian companies internationally play a big role in ensuring the success of operations.

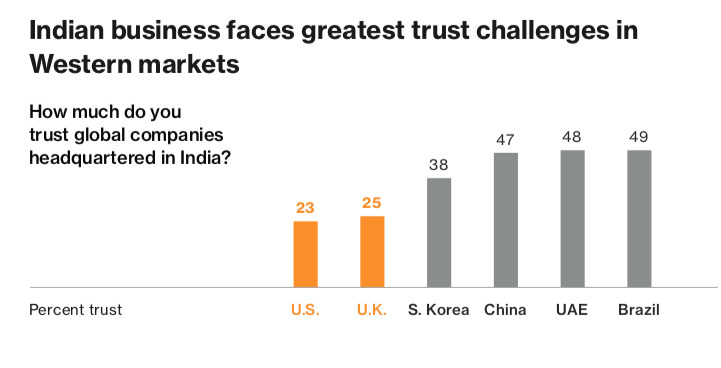

The study finds a perception challenge in key western markets, backed by a worrying 54 per cent gap between domestic and international trust in Indian business. This “trust deficit” is indicative of the kind of issues which weigh on Indian competitiveness overseas and are rooted in both the non-Indian public’s perception of what Indian brands stand for and a fundamental lack of awareness about India’s industrial prowess across sectors.

One explanation: India lacks the kind of “hero brand” which typically raises awareness in other markets. In India’s six big export markets, only 14 per cent of the respondents could say with confidence that they had knowledgably bought a product or service from an Indian company in the last 12 months.

Among the same six markets, an average of only 39 per cent of people could name one Indian brand they would describe as “world class”—and the United States and the United Kingdom, only 28 per cent and 29 per cent of people, respectively.

To succeed abroad, Indian companies need to engage more

To succeed overseas, companies also need to align with consumer expectations and values in those markets. Increasingly, consumers around the world are “belief-driven buyers” who make a conscious decision to buy from or avoid brands whose values do not align with their own. Yet, the data suggests that only 34 per cent of respondents across the six markets believe this to be true of Indian brands. Combined with two other low “trust indicators” for Indian business—trust in CEO business leadership and trust that companies treat their employees well—the nature of the challenge becomes apparent.

But India Inc. has key advantages on which it can build. On many attributes on which we measure trust in brands, India Inc. performs well: Indian executives are seen to be well-educated and competent, and Indian business is regarded as an innovative institution that creates opportunity at home and abroad.

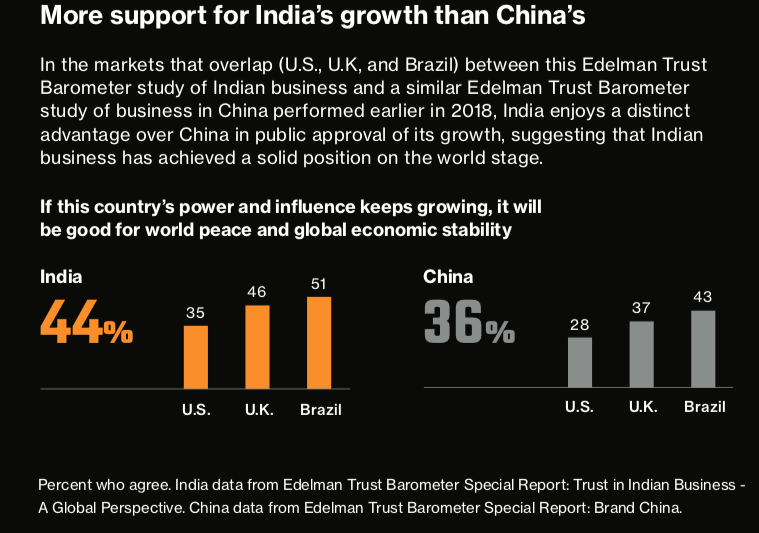

India Inc. is also holding up well against its counterpart in China, particularly on one key trust indicator: care for the environment. In fact, 44 per cent of our respondents pointed to India’s growth and strength as being good for overall peace and stability in the world, compared to only 36 per cent for China.

What’s the path ahead for India Inc., and how should Indian companies respond to the challenges they face? To create stronger perceptions, India Inc. needs to proactively engage globally and clearly define what it stands for. To do so, Indian CEOs must elevate their company, brand, even their personal profile in the public discourse beyond more traditional business indices. There is a clear opportunity and need for India Inc. to grow its stature on the world stage. The time to capitalize on that opportunity is now.

Stephen Kehoe is the global chair, reputation and Rakesh Thukral, is managing director, Edelman India.

If you enjoyed this article, you can subscribe for free to our weekly event and subscriber alerts.

Featured

PR professionals share their views on journalists publicly calling them out on story pitches

Auto blogger renders unconditional apology to Value 360 for defamatory posts

Hottest Indian startups of 2020, Paytm, Dreams 11 lead the charge: Wizikey Report