If you have watched the latest season of the wildly popular 'Special Ops' on Jio Hotstar, you would know that online payments are a major narrative device in the spy thriller. Without any further plot spoilers, the fact that UPI/online payments have reached the level of volume that it has now entered mainstream entertainment is proof of its impact on everyday financial transactions.

For context, UPI dominates the digital transactions system in India in terms of volume. As per the Press Information Bureau, UPI accounts for 85 per cent of all digital transactions in India. It now serves 491 million individuals and 65 million merchants. It connects 675 banks on a single platform, allowing people to make payments easily without worrying about which bank they use.

In June 2025, 18.39 billion transactions were undertaken through UPI.

What Phi Commerce did: The "How India Pays" report

To understand transaction trends, payment platform Phi Commerce analysed data from over 20,000 merchants across seven major sectors (Education, Retail, Utilities, F&B, Auto Ancillary, Healthcare, and E-commerce), aiming to decode actual payment behaviour beyond platform adoption. The aim is to "Establish Phi Commerce as not just a payment platform, but a strategic intelligence provider."

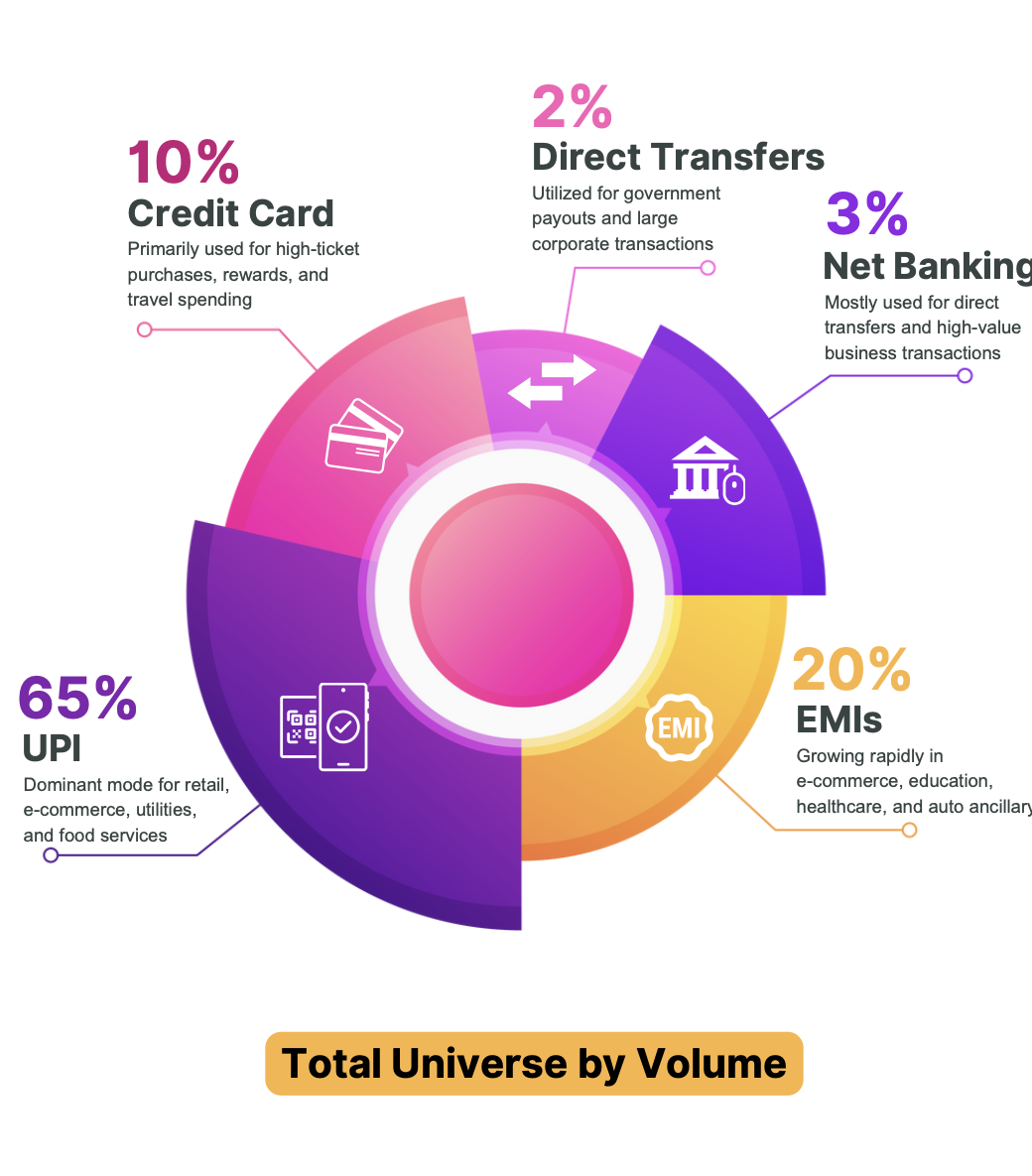

1. UPI, EMIs: Indian Payment Landscape

The report confirms the overall trends that UPI is the dominant method of online payments, followed by EMIs.

2. Sector-wise findings

The report also breaks down the transaction trends across major sectors including:

1. India’s education sector is moving from traditional methods to EMIs, credit cards, UPIs, and instant digital transactions. EMI options are a growing category within education.

2. India’s retail sector. As expected, UPI is leading everyday transactions. Credit cards are increasingly used for buying costly items. Interestingly, payment spikes take place in May and June due to the summer vacation, apart from the expected year-end festival season.

3. The food and beverage sector has fully moved to digital payments, with UPI dominating transactions and credit options gaining traction in food delivery and meal subscriptions. As restaurants and food services integrate digital-first payment solutions, consumer convenience and engagement are on the rise.

Is there a trend in the volume of payments in this always-on sector?

Findings show that food services peaked in September, driven by festive gatherings and increased dining out, while August saw the lowest activity, perhaps due to monsoon conditions, as people prefer to stay indoors, and food deliveries are also affected.

4. India’s healthcare sector is also undergoing a significant shift towards digital payments,with credit cards and EMIs emerging as key financing tools.

Healthcare payments peaked in March, driven by insurance renewals. Medical financing, insurance-linked transactions, and seasonal health trends impact payment volumes in this sector.

The sniffles season of winter also accounts for a spike in online medical expenses.

3. Media Partnerships and Press Coverage

- Mint Collaboration: Phi Commerce partnered with Mint newspaper, which identified the report as relevant to "address the rising trend of credit in the Indian digital payments landscape."

- Media Pick-up: This resulted in "over 50+ hits across all major news outlets."

- Time of India's take: "The Times of India, led with the short-term financing angle, which appeared in the print edition all-India,

4. Media Partnerships and Press Coverage

- LinkedIn Strategy: As per data shared by the company, LinkedIn posts "outperformed typical benchmarks, with an average CTR of 19.33% and over 65% engagement." The success was attributed to "Carousel content simplified complex ideas effectively, while thought leadership posts showcased strong audience appetite for in-depth, narrative-driven insights."

- YouTube Campaign: The YouTube campaign achieved an "average CTR of 1.37% and an impressive 85% engagement rate," indicating strong viewer stickiness, driven by "Teasers".

- Email Campaign: A targeted email campaign to "fintech and BFSI leaders" achieved a "100% open rate and 45% CTR, far exceeding benchmarks." Significantly, "Over 30% of recipients read the full report"

6. Internal Activation

- "Chai & Curiosity" Series: The report launch was activated internally through Phi’s 'Chai & Curiosity' series," a knowledge-sharing platform led by Tushar Shankar, Co-founder and Head of Sales."

7. Outcomes & Impact

The campaign, as per the company, performed on the following metrics:

- Brand Visibility: A "Surge in website traffic, SEO rankings, and domain authority."

- Lead Generation: "Inbound commercial leads within hours of launch; over 45% of engagement occurred within the first 12 hours of the release of the report."

- Strategic Relevance: "Engagement from senior CXOs confirmed strategic relevance."

8. Due Diligence and Ethical Data Use

A critical aspect highlighted is the commitment to ethical data practices:

- Data Transparency: "Insights are based on anonymised data from 20,000+ Phi Commerce merchants and presented in aggregate form only."

- Privacy Protection: "No PII or individual merchant details were accessed or shared during the analysis."

- Regulatory Alignment: "Fully aligned with RBI’s Digital Payment Security guidelines, IT Act, 2000, and principles of the upcoming Data Protection Bill."

Our Take

The report is an important piece of research with a sizeable sample size of 20,000 merchants across several key sectors. Would like to have seen more of:

a) What specific questions were businesses and policymakers asking about digital payments? Did the insights derived from the data help to answer these?

b) Would have liked to see comments from the merchants in the study about how the findings helped them.

c) What are the plans for this report? Did this campaign change the conversation around digital payments in India? What is the long-term vision for Phi Commerce as a "strategic intelligence provider"?

If you enjoyed this article, you can subscribe for free to our weekly event and subscriber alerts.

We have four email alerts in total - covering ESG, PR news, events and awards. Enter your email address below to find out more: