In part 2 of the PRmoment Confidence Survey 2025 results, we focus on what in-house corporate communications professionals have to say. PRmoment India teamed up with CensusWide to survey the PR and comms sector.

This comprehensive and confidential survey explores key growth trends and forecasts priority sectors for the coming months. Drawing insights from a demographic primarily aged 25-45 across India’s major metros, and comprising 60% women, the data offers a clear view of what the Inhouse PR professionals view as the key challenges ahead for the comms and PR industry. Talent is one of the major headwinds.

The survey found that respondents feel C-suite confidence in their corporate communications team for crisis management is very high at 91.07%. Interestingly, men reported higher C-suite confidence (96.30%) than women (85.71% ).

In fact, all the "Not confident" responses came from the female cohort.

On the business impact of PR

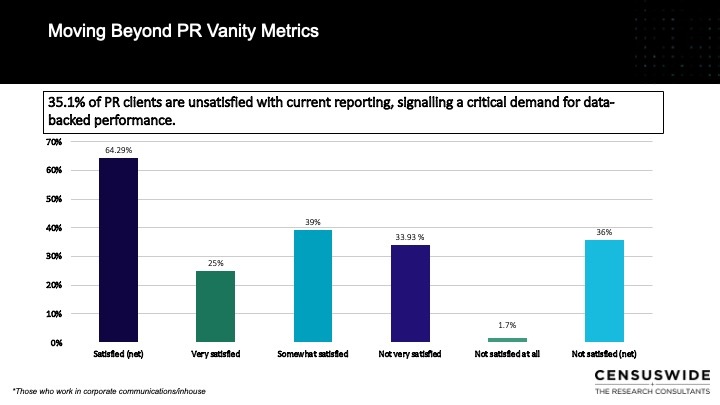

35.1% of the respondents say they are not satisfied with the way their PR service provides impact measurement.

Voices from the Industry

Aman Dhall, founder, CommsCredible, says, "2026 will be the year of the full-stack storyteller. Someone who listens with depth, writes with clarity, understands search behaviour, and uses AI with intention. They will bring emotional intelligence, editorial discipline, and treat technology as a creative companion rather than a shortcut.”

Satisfaction with the PR provider's measurement protocol

In-house teams show mixed satisfaction with their PR provider's measurable results, with 64.29% "Satisfied", but a large group (35.71%) "Not satisfied."

Gender, Leadership Snapshot

Men (74.07%) are notably happier than women (53.57% net) in-house professionals about the way PR impact is measured. When it comes to leadership, over 15 years of experience in the profession are the least satisfied with the measurement of PR.

Unfiltered Voices

"There is too much clutter, and everybody more or less is speaking about AI and reputation in different places and times, and everybody seems to be an authority. However, how AI can be applied is different. Additionally, PR agencies continue to lose good people owing to management in agencies making tall claims which are unachievable. They don't have a clue what's happening on the ground and need to conduct fewer showcases and awards and sit across the table with the media to discuss the future of both sides."

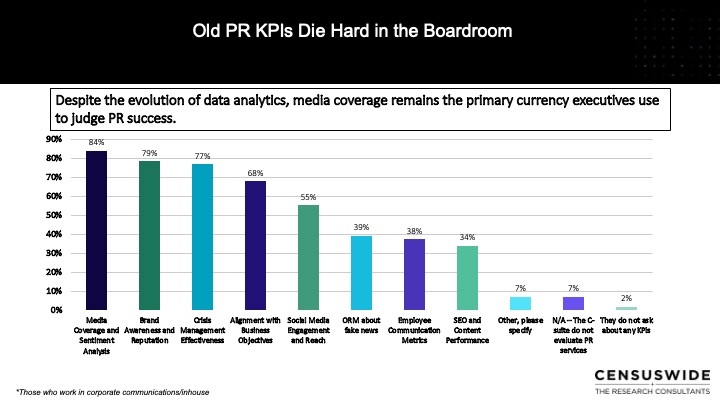

What KPIs do C-suite want for evaluating the impact of PR

There isn't much change in what the C-suite asks for from PR, as per in-house respondents to the survey.

The top KPIs C-suites ask for are "Media coverage and sentiment analysis" (83.93%). This is closely followed by "Brand awareness and reputation" (78.57%) and "Crisis management effectiveness" (76.79%).

This result is consistent across cities, gender and across the number of years in the PR job.

The one place where there was a difference in gender responses was about business objectives. Men placed a much higher emphasis on "Alignment with business objectives" (81.48%) than women did (53.57%).

Voices from the Industry

"The lack of understanding among top leadership across organisations on how PR isn't a magic wand, how it needs consistent attention and mindspace investment from leaders. Unreal expectations and little growth in budgets, given the lack of adequate understanding among top leadership across corporations, is a significant headwind."

With media houses in India all having strong online platforms, often much larger than mainstream print or traditional TV news, earned media has become important. And in-house teams agree.

Our survey shows that earned social content is a major strategic component for in-house teams. A majority (58.93%) state it is "highly integrated" into the main PR strategy. However, 35.71% say it is "supplementary" to the main PR efforts.

Voices from the Industry

80dB co-founders Gurgaon-based Abhilasha Padhy and Bangalore-based Kiran Ray Chaudhury say, "One area we are doubling down on is video-led storytelling, because that’s where brand attention, recall, and trust are converging. We plan to significantly expand our video capability, bringing together editorial thinking, creator-style agility, and platform-native formats to help brands communicate with far greater impact."

City Snapshot

As expected, the techie city Bangalore reported the highest earned social media integration (66.67% "Highly integrated"), while Delhi reported the lowest (50%).

📊 Principal Headwinds for PR: The In-House Perspective

The main areas of concern are as follows:

- The Talent Crisis is Paramount: The most consistent complaint is not just finding people, but finding capable people who can think strategically and handle digital tools.

- The "Vendor" Trap: A major headwind is the struggle to move up the value chain. As long as clients view PR as a low-cost distribution channel rather than a strategic reputation driver, fees will remain depressed.

- Identity Crisis: The industry is caught between legacy media relations (which is dying) and digital/influencer marketing (where they face stiff competition from ad/digital agencies).

| Category | Specific Headwinds | Business & Operational Impact | Intensity |

| Talent & Workforce | Skills Gap & Quality: Severe shortage of talent with modern skills (digital, analytics, strategy). Perception of young talent as "lazy" or lacking depth/general awareness. High Attrition: Constant churn of mid-level professionals to in-house roles or other sectors offering better work-life balance and pay. | • Inability to deliver strategic consultancy beyond basic execution. • Loss of institutional knowledge and client continuity. • Increased training costs with diminishing returns due to turnover. | Critical (High Frequency) |

| Financial & Market Model | Pricing Pressure: Commoditization of services leading to fee undercutting and "price wars" among agencies. Budget Cuts: Clients reducing retainers, treating PR as a non-essential "cost center," or demanding "more for less" amidst economic uncertainty. | • Shrinking profit margins making it difficult to pay competitive salaries. • Agency instability and inability to invest in new tools/tech. • Shift toward high-volume, low-quality "vanity" work to justify fees. | Critical (High Frequency) |

| Media Ecosystem | Fragmentation & Saturation: Decline of traditional media coupled with an explosion of digital/vernacular channels and influencers. Blurring Lines (Paid vs. Earned): Rise of "paid news" and influencer-driven models making organic coverage harder to secure. | • Traditional "media relations" playbooks are becoming obsolete. • Difficulty in differentiating brand narratives in a cluttered space. • Increased cost of operations to manage complex, multi-channel mandates. | High |

| Client Relations & Value | Measurement & ROI: Relentless client pressure to prove value through quantifiable metrics (ROI) rather than long-term reputation building. Tactical Perception: PR is often viewed as a tactical "vendor" service (press release distribution) rather than a strategic partner at the CXO table. | • Short-termism: Strategy is sacrificed for "quick wins" and viral moments. • Strained client-agency relationships due to unrealistic expectations. • High client churn rates. | High |

| Technology & Innovation | Digital & AI Disruption: Slow adoption of AI and analytics; struggle to transition from legacy methods to digital-first storytelling. Misinformation: The speed of fake news, deepfakes, and "purpose washing" creating crisis scenarios. | • Agencies failing to adapt risk becoming irrelevant. • heightened reputation risk requires 24/7 monitoring capabilities. • Loss of credibility due to "inorganic" or AI-generated spam content. | Medium-High |

| Ethics & Reputation | Trust Deficit: Declining trust in media and the PR profession itself due to opaque practices, greenwashing, and unqualified practitioners. Regulatory Uncertainty: Navigating a volatile political and regulatory landscape (censorship, local sensitivities). | • skepticism from stakeholders reduces the effectiveness of campaigns. • Legal and reputational risks for both agencies and clients. • Credibility crisis for the industry at large. | Mediu |

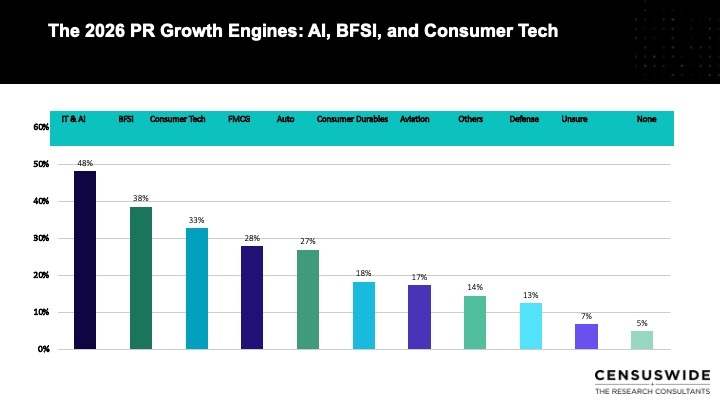

The 2026 PR Growth Engines

Both PR firms and in-house respondents consistently picked the following as their top areas of growth

| Sector picked by respondents | AI and IT | BFSI | Consumer Tech | FMCG |

Why the sector matters | Essential Digital Infrastructure | Industry Transformation | Focus on AI-led personalisation marketing, privacy policy and use of data | D2C and e-commerce |

Overall, IT and AI (48.08%) is the clear winner for future growth. It is followed by BSFI (38.46%), Consumer Tech (32.69%), FMCG (27.88%), and Auto (26.92%).

Voices from the Industry

Dr Sarvesh Tiwari, founder & managing director of PR Professionals, says, "2026 will be the year of reputation and crisis management, as brands operate in an environment of heightened scrutiny and rapid information flow. While we continue to strengthen our presence in infrastructure, real estate, and power, we are deepening our focus on BFSI, banking, and FMCG sectors that demand consistent credibility, transparency, and proactive communication.”

Other sectors of interest

Anecdotal responses to the survey under open questions also shared that their pitches fell under logistics, gaming, real estate, government, infrastructure and PSUs, VC funds, lifestyle and non-profits.

Respondents also said, "Startups being able to fetch money from investors and aiming at listing IPOs" was an area of PR uptake, along with healthcare, pharma, education and lifestyle.

Generation Gap, BFSI vs. Consumer Tech

It's also interesting to note the generation gap guiding sector picks. The top pick for senior leadership (Over 15 years of work experience) is BSFI, whereas young professionals with 3 to 5 years of work experience picked consumer tech.

City Scan: Industry sector priorities city-wise

Gurgaon was the most bullish on IT/AI, as, not surprisingly, was Bangalore. Bangalore also picked consumer Tech as joint #1 with IT/AI.

Delhi was the only city where BSFI (47.62%) ranked higher than IT/AI (42.86%). Mumbai aligned with the overall trend, picking IT/AI (46.15%) first and BSFI (41.03%) second.

The Strategy Gap: Predicted Growth vs. Actual Pitch Activity

The data reveals some mismatch between the predicted growth engines for 2026 vs what they picked in 2024-2025.

For example, 31% of respondents said they pitched for healthcare work, whereas it did not figure at all in the top 6 picks for 2926.ESG is another example. Only 6% of the respondents pitched for ESG PR contracts in FY 2024-2025. However, when asked which PR services will grow in 2026, 25% of the respondents still felt PR for ESG would have strong demand.

In comments, respondents also pointed to development and social impact, healthcare and NGOs as areas of

This is inspite of the devastating impact on ESG and non-profit aid by US President Trump's policies.

If you enjoyed this article, you can subscribe for free to our weekly event and subscriber alerts.

We have four email alerts in total - covering ESG, PR news, events and awards. Enter your email address below to find out more: