It is nearly December 2025, and what a year it has been for the communications sector. To understand the defining industry trends of the last 12 months, PRmoment India teamed up with CensusWide to survey the PR and comms sector.

This comprehensive and confidential survey explores key growth trends and forecasts priority sectors for the coming months. Drawing insights from a demographic primarily aged 25-45 across India’s major metros, and comprising 60% women, the data offers a clear view of where the business stands today.

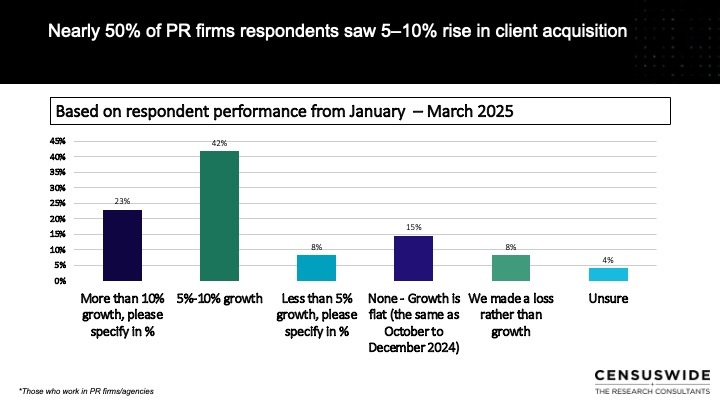

Geopolitical and tariff uncertainties mean that client growth trends in January to March 2025 were positive but mixed. The largest group of respondents (41.67%) said they achieved 5-10% growth, while 22.92% saw over 10% growth. 14.58% reported flat growth, and 8.33% experienced a loss.

Voices from the Industry

Right now, the industry is going through chaos, much like the geopolitical environment. Long-term plans for brands have taken a hit since the pandemic, and it continues. Investments for quick gains, even in PR terms, will be on the rise, in my opinion. Long-term vision-led plans will be slow, hence a slowdown in big mandates. However, if it is not true for reputation issues, crises arise from the same chaotic environment."

City Snapshot

Mumbai showed the strongest, most stable growth, with 50% reporting 5-10% growth and only 5% reporting a loss. Respondents from Delhi and Bangalore showed similar results, with a 5-10% growth bracket being the most common. Gurgaon had the highest percentage of firms reporting a loss (18.18%).

Gender based responses

Interestingly, when it came to gender responses, more women ( 50%) than men (26.6%) reported a 5 to 10% growth in client acquisition. Conversely, more men reported over 10% growth (26.67% vs. 18.75%). Men were also significantly more likely to report a loss (20% vs. 3.13% of females).

Unfiltered Voices

"Agencies which are part of the global groups are not putting in enough effort to offer something new. Because if you see the trend, the HQs don't see any value in India as a market."

We asked our PR firm respondents three key questions to understand the pitching trends.

The number of pitches they took part in from April 2024 to March 2025.

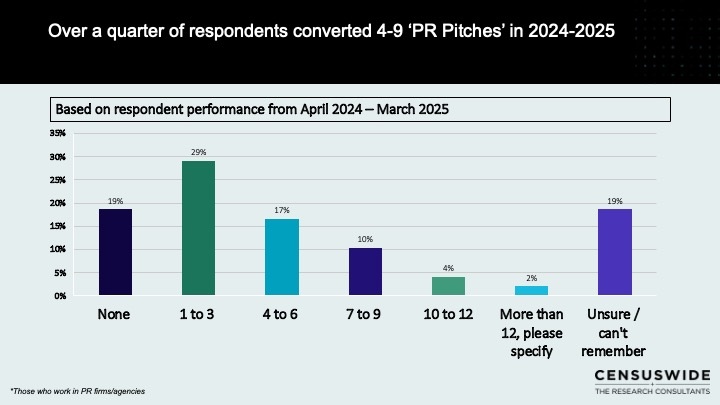

According to respondent comments, participation in pitching events for 2024-2025 is varied, and the volume of pitching has been moderate. The most common response is "More than 12" (29.17%). This is followed by "Unsure" (18.75%) and "7 to 9" (16.67%).

Voices from the Industry

"One of the biggest challenges plaguing our industry is the fragmentation within it. Having worked in the agency set up for the longest part of my career, it’s imperative to understand the pain agencies take to arrive at a good pitch, which at times prospects tend to dismiss in the hunt for cheaper fees."

City Trends

Gurgaon respondents were the most successful, with 36.36% reaching "10 to 12" finals. Delhi reported the lowest volume, with "1 to 3" (33.33%) as the peak. Bengaluru was polarised, with 25% at "1 to 3" and 25% at "More than 12". Mumbai had an even spread.

Total Pitches won

Bengaluru had the highest share of firms winning "1 to 3" pitches (37.50%). Delhi had the least, with 33.33% reporting "None." Gurgaon had the highest share of high-volume wins ("7 to 9" at 18.18%). Mumbai showed strong results, with 30% winning "1 to 3" and 20% winning "4 to 6."

Overall, the top result is "1 to 3" wins (29.17%). This is closely followed by "None" (18.75%), "Unsure" (18.75%), and "4 to 6" (16.67%).

Bangalore-based Shashank Bharadwaj, managing partner at BrandArc Reputation Advisors and founder of PRCC, who partnered with PRmoment on this survey, said, "The rise of paid placements and advertorial-led expectations has also changed how brands view PR. More organisations now see PR as reputation management rather than pure media relations, and that change is here to stay. Further, influencer engagement mandates, even when not standalone, are adding to the topline of PR agencies.

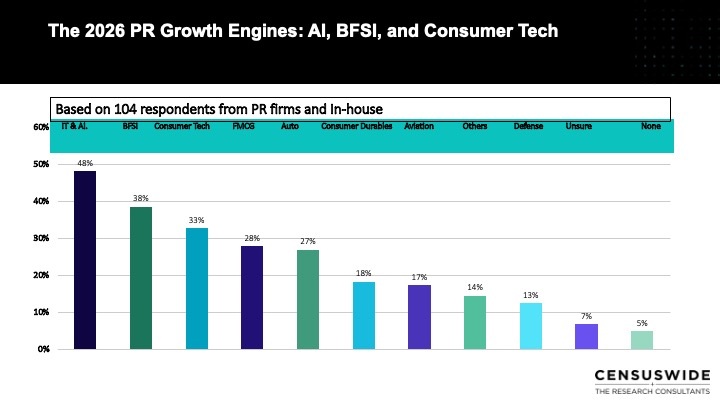

The 2026 PR Growth Engines

Both PR firms and in-house respondents consistently picked the following as their top areas of growth

| Sector picked by respondents | AI and IT | BFSI | Consumer Tech | FMCG |

Why the sector matters | Essential Digital Infrastructure | Industry Transformation | Focus on AI-led personalisation marketing, privacy policy and use of data | D2C and e-commerce |

Overall, IT and AI (48.08%) is the clear winner for future growth. It is followed by BSFI (38.46%), Consumer Tech (32.69%), FMCG (27.88%), and Auto (26.92%).

Deepshikha Dharmaraj, CEO, Burson Group India, "We are already delivering GEO services to clients across markets. As the world rapidly shifts into a zero-click era, where AI answer engines are becoming the primary gateway of reputation, optimising how brands appear in these new search results is a clear communications priority."

Tamanna Gupta, founder of Umanshi Marketing & PR, says, "The PRmoment survey signals strong growth across AI, BFSI and consumer tech in 2026. For founder-led businesses, the priority now is to match that market momentum with internal communication maturity. Many founders still rely on intuition-led decisions and ad hoc messaging.

But high-growth sectors require high clarity of communication. Teams need documented narratives, GTM playbooks and alignment on how the brand speaks to customers and stakeholders. These basics reduce noise and make PR, marketing and sales far more effective. Systems do not replace the founder. They give the founder the headspace to operate at the strategic level that the market now demands."

Other sectors of interest

Anecdotal responses to the survey under open questions also shared that their pitches fell under Logistics, gaming, real estate, government, infrastructure and PSUs, VC funds, lifestyle and non-profits.

Respondents also said, "Startups being able to fetch money from investors and aiming at listing IPOs" was an area of PR uptake, along with healthcare, pharma, education and lifestyle.

Generation Gap, BFSI vs. Consumer Tech

It's also interesting to note the generation gap guiding sector picks. The top pick for senior leadership (Over 15 years of work experience) is BSFI, whereas young professionals with 3 to 5 years of work experience picked consumer tech.

City Scan: Industry sector priorities city-wise

Gurgaon was the most bullish on IT/AI, as, not surprisingly, was Bangalore. Bangalore also picked consumer Tech as joint #1 with IT/AI.

Delhi was the only city where BSFI (47.62%) ranked higher than IT/AI (42.86%). Mumbai aligned with the overall trend, picking IT/AI (46.15%) first and BSFI (41.03%) second.

The Strategy Gap: Predicted Growth vs. Actual Pitch Activity

The data reveals some mismatch between the predicted growth engines for 2026 vs what they picked in 2024-2025.

For example, 31% of respondents said they pitched for healthcare work, whereas it did not figure at all in the top 6 picks for 2926.ESG is another example. Only 6% of the respondents pitched for ESG PR contracts in FY 2024-2025. However, when asked which PR services will grow in 2026, 25% of the respondents still felt PR for ESG would have strong demand.

In comments, respondents also pointed to development and social impact, healthcare and NGOs as areas of

This is inspite of the devastating impact on ESG and non-profit aid by US President Trump's policies.

📊 Principal Headwinds for PR: The Impact Matrix

| Domain | The Headwind (Challenge) | The Consequence (Reality) |

| Talent & Workforce | Investment Stagnation: Agencies are under-investing in training, and PR retainers are failing to beat inflation compared to social media. | The Brain Drain: Bright talent is bypassing the industry. Current staff are "pandering to short-term gains" rather than developing strategic, long-term skills. |

| Clients & Budget | The Performance Pivot: Companies are prioritizing performance marketing over PR, leading to budget constraints. | Devaluation: Agencies are lowering fees to retain clients ("reducing retainers"), creating a "crabs in a barrel" environment where value is difficult to prove. |

| Media Landscape | The Influencer Shift: Traditional media is declining in relevance while independent content creators dominate. | Generational Disconnect: Reliance on conventional media is "alienating Gen Z." The line between genuine journalism and paid influence is dangerously blurred. |

| AI & Technology | Adoption Lag: A struggle to transition to data-based research and use AI as an assistant rather than viewing it as a threat. | Narrative Erosion: Talent risks losing the ability to "think and craft narratives" independently. The industry remains too focused on reactive stories rather than data-led strategy. |

| Trust & Ethics | The Credibility Gap: A surge in viral misinformation ("fake narratives") and pressure for inorganic/paid coverage. | Reputation Risk: Agencies face a "trust deficit." Stakeholders are exhausted by "pushy" tactics, and the gap between content quantity and quality is widening. |

| Strategy | Hierarchy Issues: PR is often still reporting into Marketing rather than standing alone. | Limited Scope: The industry remains confined to tactical "media relations" rather than strategic reputation management. |

If you enjoyed this article, you can subscribe for free to our weekly event and subscriber alerts.

We have four email alerts in total - covering ESG, PR news, events and awards. Enter your email address below to find out more: