The advertising and communications industry faces an existential question: Can legacy holding companies survive the AI revolution? The storied marketing services firm WPP, has seen its share price plummet 57% in a year and dropped out of the FTSE 100 for the first time in 30 years.

Recent press reports talk of further consolidation of it's advertising business— per this story on Financial TImes. There are also unconfirmed news reports of a possible further restructuring of PR firm Burson.

WPP declined to comment on the press reports about the setting up of WPP Creative and restructuring of Burson.

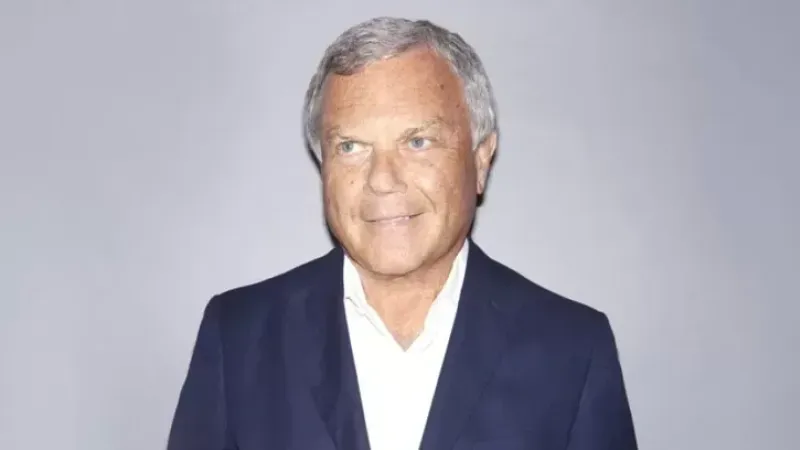

In the midst of all this we speak to WPP's founder and former chief, Sir Martin Sorrell for insights on the future of the holding company model. The 81-year-old spent 33 years building WPP before his 2018 exit, and has spent the years since advocating for holding companies that embrace tech and AI rather than cling to legacy structures. As WPP CEO Cindy Rose prepares for WPP's 'Strategy Update on February 26th,' we asked Sorrell a direct question: Can traditional holding companies pivot fast enough to compete in an age of generative AI?

PRmoment India: Is the traditional holding company model becoming obsolete, and do the current shifts at holding firms support that narrative?

Sir Martin Sorrell: The traditional holding company model isn't just under pressure; it is fundamentally challenged. What we are seeing with the recent OI (veh!?) mega-merger is two companies huddling together, when the cold wind blows. It is a consolidation of legacy-orientated over-capacity in order to reduce costs, not a strategy for growth. We are looking at an advertising revenue market where $900 billion in digital spend is heading north, while the $300 billion traditional spend is heading south, particularly when you don't have live sports to defend your legacy position.

The industry is currently splitting into two camps: those organised for a geo-politically and technologically challenged future and those organised for the past.

Omnicom is particularly vulnerable because they prfioritize discipline first, then client, and geography last. No matrix is perfect but this is a major mistake in a slower growth, higher inflation and interest rate environment. When you lead with discipline, you trigger internal turf wars as vertically-organised discipline CEOs fight for revenue attribution. Clients want one operating company and execution.

In contrast, Publicis and S4's Monks recognize that the game has changed. In 2026, you must move at speed in Riyadh, Singapore, or New York without waiting for a global head of discipline to approve a P&L shift. At Monks, we take this further by operating as a unitary business with a single P&L. This removes friction, allowing us to focus entirely on delivering results that are faster, better, cheaper, and more. While the incumbents manage their contraction by claiming “simplicity” and slamming brands together through press releases, we are scaling the only model natively built for the AI era.

PRmoment India: Can legacy firms successfully pivot to meet the AI challenge while managing existing debt, or is this "managed contraction"?

Sir Martin Sorrell: Let’s be blunt: this is a managed cost contraction, not a transformation. You cannot pivot a legacy structure, with well over 100,000+ employees trained for a labor-based era.

We’ve already seen Omnicom and IPG shrink from 127,500 to 104,000 even before their deal was approved by regulatory authorities. That isn't growth; it's surgery. My guess is a further 7,500 jobs will go to meet the $750 million “synergy” target, which was trumpeted as the stock market reason for the merger in the first place. And this is all before AI gets to grips with our industry.

AI is the Oppenheimer moment for marketing. It fundamentally collapses the time and cost of production. A $2.5 million campaign that used to take four months can now be delivered for $500,000 in four weeks. Legacy firms that charge based on hours with the 'time-driven' model are existentially threatened by this.

They are transparently untransparent about their margins because their old workflows simply cannot survive this level of compression. Algorithmic AI executions like VO3, Sora, Runway, Luma, Minimax allied with Google’s PMax and Meta’s Advantage+ will develop into an end-to-end model incorporating creative, production and media and ensuring complete client transparency in media planning and buying, eliminating all current frictions and opacity in the media ecosystem.

At S4 and Monks, we are already moving toward output-based pricing, subscription models and agentic workflows with a model built for output, not hours."

If you enjoyed this article, you can subscribe for free to our weekly event and subscriber alerts.

We have four email alerts in total - covering ESG, PR news, events and awards. Enter your email address below to find out more: